Table Of Content

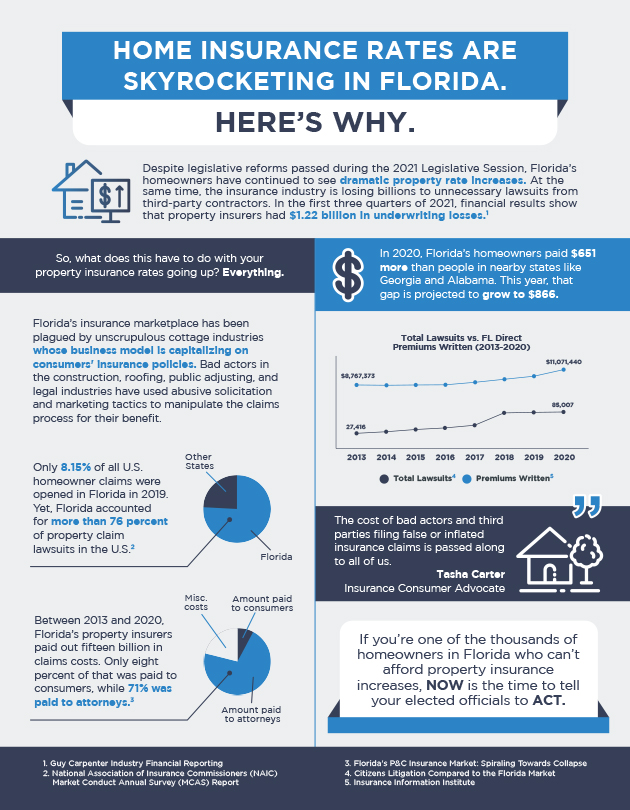

The contractor can then hire an attorney, often before talking to the insurance company. With the news that Florida Peninsula Insurance and Heritage Property Insurance were slashing claim payouts to homeowners after Hurricane Ian, now it’s more important than ever to find a company with high claims satisfaction. Power’s 2023 Claims Satisfaction Study or the National Association of Insurance Commissioners Complaint Index for a look at what companies fare well when it comes to claims and customer service. Universal Property home insurance offers cheap rates and lots of coverage add-ons, including a rare private flood insurance endorsement with up to $5 million in protection.

Common questions about homeowners insurance

Tower Hill home insurance offers cheap rates and lots of coverage add-ons, including a rare private flood insurance endorsement with up to $5 million in protection. And it doesn't skimp on coverage, offering flood, wildfire, and earthquake protection — one of few competitors that offers all three insurance policies to homeowners in many high-risk states. "Homes with low disaster risk and low insurance costs will likely become increasingly popular, and thus more valuable, as the dangers of climate change intensify."

Bundle auto and homeowners insurance

Chris is a seasoned writer/editor with past experience across myriad industries, including insurance, SAS, finance, Medicare, logistics, marketing/advertising, and many more. Among the insurers we evaluated in Florida, Chubb drew the fewest complaints to state regulators for a company of its size, according to the National Association of Insurance Commissioners. These are sample rates and should be used for comparative purposes only. Our goal is to give you the best advice to help you make smart personal finance decisions.

Best Home Insurance Companies (

NerdWallet’s homeowners insurance ratings reward companies for customer-first features and practices. Ratings are based on weighted averages of scores in several categories, including financial strength, consumer complaints, coverages, discounts and online experience. These ratings are a guide, but we encourage you to shop around and compare several insurance quotes to find the best rate for you.

An insurance company could also increase rates based on other factors, including inflation and higher building costs. By law, Florida insurance companies must offer homeowners insurance discounts to policyholders whose homes are less likely to suffer wind damage. For example, you can save money by adding storm shutters or upgrading how your roof is attached to the rest of your house. The amount of coverage you purchase is one of the biggest factors that impacts your home insurance premium. More coverage generally costs more money, but also provides more financial protection. Below are the average Florida homeowners insurance rates by coverage level.

Home Insurance Calculator: Estimate Your Costs (2024 Rates) - Forbes

Home Insurance Calculator: Estimate Your Costs (2024 Rates).

Posted: Wed, 03 Jan 2024 08:00:00 GMT [source]

They can be so aggressive that they put flyers on every doorknob in many neighborhoods, while offering $500 gift cards. The situation became so bad that the state legislature passed a law, signed by Gov. DeSantis, restricting contractors from using “prohibited advertisements” to encourage homeowners filing insurance claims for roof damage. Jennifer Gimbel is a senior managing editor and home insurance expert at Policygenius, where she oversees our homeowners insurance coverage. Previously, she was the managing editor at Finder.com and a content strategist at Babble.com. Homeowners insurance generally covers the cost of repairs if your home is damaged by wind or hail. However, since Florida sees frequent hurricanes, tropical storms, and tornadoes, policies often exclude coverage for wind and hail in high-risk areas.

Flood insurance

Also, they don’t have backup funds from organizations like the Hurricane Catastrophe Fund, which pays claims when an insurance company can’t pay claims after a significant hurricane. Gov. Ron DeSantis says he expects the state’s insurer of last resort, Citizens Property Insurance Corp., won’t have issues paying out property damage claims related to the hurricane. Citizens’ membership has skyrocketed to nearly 1.1 million members as home insurance companies have fled the state or gone out of business. Citizens, the state’s insurer of last resort, has taken on a bigger role in the home insurance market as companies have left the state, stopped selling new policies or gone out of business. Citizens Insurance now has over 1.2 million homeowners and that’s expected to reach 1.5 million policyholders by the end of the year.

Cheapest Homeowners Insurance for Different Homeowners

In addition to looking at how much each insurance company charges for different coverage levels and risks, you should also be aware of what your policy does and doesn’t cover. To recoup the losses from the combination of natural disaster claims and litigation expenses, Florida insurance companies are consistently filing for rate increases each year with the Florida Office of Insurance Regulation. Older and historic homes are usually more expensive to insure than newer homes.

How Much Is Home Insurance in Florida?

So if your home is insured for $200,000 and you have a 5% hurricane deductible, you’ll need to pay $10,000 before any insurance company steps in to pick up the remaining damage. With the inherent risk of hurricane damage to homes increasingly growing year after year, some Florida home insurance companies have either decided to stop writing policies in Florida or have gone out of business altogether. When it comes to those looking for cheap home insurance, Florida residents will find that averages for each county are nearly cut in half for those with wind mitigation features in effect. For instance, for $450,000 houses, Miami-Dade is by far the most expensive, averaging $15,280 and $24,336 for those without wind mitigation features. But homes built from 2001 to the present day average $9,635 per year, an astounding $14,701 less than their non-wind-mitigated neighbors. The average cost of homeowners insurance in Florida is $2,533 per year for a $150,000 house, $4,386 per year for a $300,000 house and $5,849 per year for a $450,000 house.

By law, homeowners insurers in Florida must offer coverage for “catastrophic ground cover collapse,” a specific type of sinkhole damage. You may pay more or less than the state average for your homeowners insurance, depending on where in Florida you live. For example, the average cost of homeowners insurance in Miami is $5,315 per year, while homeowners in Orlando pay about $2,760 per year, on average. If you have received a nonrenewal or cancellation notice in regard to repairs or updates needed on your home, the best course of action may be to contact your provider right away. There is a chance the company could rescind the nonrenewal if you can provide the necessary documentation.

A Florida homeowner’s insurance premium jumps to $2,544 a year, on average, after filing a claim for wind damage, based on our data. Wind-damage claims cause an even bigger hike, to an average of $2,659 a year. These disasters have impacted the average Florida homeowner in many ways, too. Generally speaking, they’ve caused the state’s home insurance rates to increase. More specifically, they prompt individual homeowners’ rates to go up after they make disaster-related claims.

The cost of Florida home insurance has never been higher, but homeowners have been dealing with a turbulent home insurance market since 2019. There are several reasons why homeowners insurance in Florida is problematic for both homeowners and insurance companies. The biggest reason is the same reason why so many Americans flock to Florida for vacation every year — location. Take a look at the average rates by county in Florida below to see how costs compare. Florida faces a property insurance crisis, with rates rising fast, which makes finding affordable Florida homeowners insurance from a solid company harder, especially if you live near the coast.

Private insurers have been trying to cut their losses in the state by reducing coverage or refusing to renew policies. Since 2017, 11 companies that offered homeowners insurance in Florida liquidated—five of which did so in 2022. Other insurers are canceling policies or choosing not to renew them, leaving Florida homeowners with fewer options and higher premiums. A number of homeowners across Florida told The USA TODAY Network-Florida that they had dropped – or were considering dropping – wind coverage from their insurance policies in order to save money. While it would decrease their annual policy costs, they acknowledged that it could leave them out of luck should a hurricane hit their home. Personal property coverage helps pay to repair or replace furniture, clothes, electronics, tools, and other belongings if they're destroyed in a covered loss.

Florida lawmakers pitch radical idea to solve property insurance crisis - Tampa Bay Times

Florida lawmakers pitch radical idea to solve property insurance crisis.

Posted: Tue, 06 Feb 2024 08:00:00 GMT [source]

Our partners cannot pay us to guarantee favorable reviews of their products or services. Most of Central and South Florida rates between very high and relatively moderate on FEMA's National Risk Index for wildfires. According to Triple-I, over 814,000 homes were considered at risk for extreme wildfires in 2022. Discounts and qualifications vary by insurance company, so be sure to talk to your carrier about your specific situation. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Penny enjoys translating the complexities of insurance into easy-to-understand advice and tips to help consumers make the best choices for their needs. Her work has been featured in numerous major media outlets, including The Washington Post and Kiplinger’s. If your potential home is in an area prone to natural disasters, you might also want to buy separate policies like flood insurance and earthquake insurance. California, Maryland and Massachusetts don’t allow home insurance companies to use credit as a factor in rates. Your home’s market value is based on its worth when selling or buying it.

As one of the best Florida homeowners insurance companies, we’re dedicated to getting you the best prices while providing best-in-class customer service. As you can see above, there are three main categories insurers use to calculate the average cost of homeowners insurance in Florida. The two categories, homes built before 2001, are split between those homes with wind mitigation features in effect and those without wind mitigation features in effect. And with flooding becoming more frequent, especially with the severe storms Florida receives, you may want to consider flood insurance. All of these factors are taken into account by insurers when pricing policies. But the cost for the same amount of coverage can vary significantly among insurance companies.

No comments:

Post a Comment